There have been growing acceptance by consumers especially in Indonesia, China, India and Thailand which had been hit hard by the pandemic, and elsewhere in the APAC region that fortified foods have an impact on immunity.

There have been growing acceptance by consumers especially in Indonesia, China, India and Thailand which had been hit hard by the pandemic, and elsewhere in the APAC region that fortified foods have an impact on immunity.

The case to support consumption of fortified foods has been proven by the pandemic experience which extends for almost 3 years, and signify the importance of maintaining a good immune system to fight against infections and other diseases.

China is a leading market in this product category leading in both immune support bottled water and baby food. Ingredients like zinc, vitamin C and ginger are commonly used in bottled water, while baby food contains probiotics, zinc and iron content. A recent report by Euromonitor International highlighted that bottled water, baby food and tea dominated the market for immune support category in this region in 2022. (see Chart 1.0)

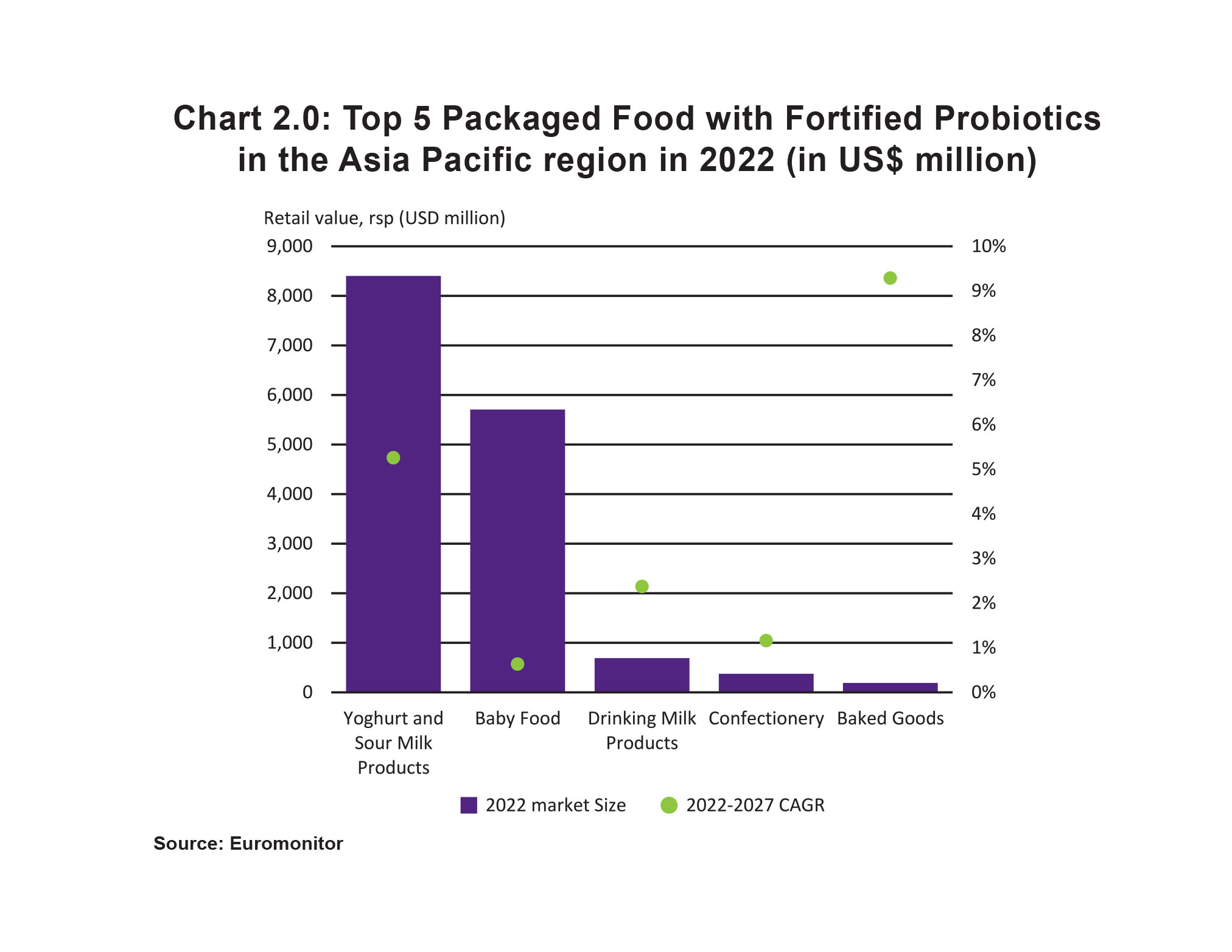

Meanwhile, consumers in the Asia Pacific region often associated products which contain probiotics to be yoghurt and sour milk products. These 2 product categories contributed 47% of overall probiotics food and drinks market in the region (see Chart 2.0).

Products with immune support claims and probiotics have enjoyed robust demand in recent years due to the pandemic. There are now more R&D efforts to diversify the use of pre- and pro-biotics into other products like confectionery and baked goods.

Finally, products with high protein contents are also frequently sought after due to its energy restoration and overall health benefits.

Consumers are seeking healthier options in staple foods like for example high-protein rice and drinking milk (see Chart 3.0). High protein snack bars, considered as a niche segment, is also growing in popularity not only among bodybuilders and athletes but also among the general population who are looking for that extra boost of energy.

There is also rapid growth of plant-based milk with high protein benefits, offering a good alternative for consumers who are lactose intolerant or are looking for sustainable sources of protein in their diets. In addition, plant-based milk also attracts ‘occasional drinkers’ who seek alternatives to the normal dairy milk products. With greater innovations in this space in terms of texture, mouthfeel and flavors, there is certainly much room for market expansion.