The latest report by Mintel this year highlighted a rise in new launches of plant-based drinks using oats, soy, pea, almond, sesame, nuts and the likes with added or high protein. Indeed, protein is an important purchasing criteria for many plant-based drink consumers in Asia.

The latest report by Mintel this year highlighted a rise in new launches of plant-based drinks using oats, soy, pea, almond, sesame, nuts and the likes with added or high protein. Indeed, protein is an important purchasing criteria for many plant-based drink consumers in Asia.

In China, nearly half of consumers (48%) cited ‘high protein content’ as the most important feature when purchasing plant-based drinks. In terms of protein content, consumers also demand transparency around quality as well as quantity, although quantity is far more important in brand marketing.

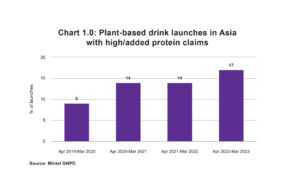

Latest findings from Mintel reported a rise in launch for plant-based drinks with added protein in the year leading to March 2023 (see Chart 1.0). Mintel has attributed this rise in activity to the growing appeal of food and drink products that cater to consumers who are living an ‘athleisure’ lifestyle – the trend of combining athletic and leisure pursuits.

Within the plant-based milk category, Asian producers often specify the protein source as a form of brand marketing for eg. soy protein sourced from US or Canada to signify the product is made of quality imported ingredients. Or, they made a claim that their products contain more protein than dairy milk to attract consumer attention.

Despite recent innovations in using other forms of plant-based ingredients like pea, oats and nuts, the traditional age-old soy milk, which originated more than a thousand years ago in China, has the most protein of all the plant-based milk options. It contains 7 to 20g of protein per 8 ounce serving. Many soy milk and other plant-based milk brands also add protein and other nutrients to their milks to be on par with dairy milk in terms of nutritional content.

Nevertheless, apart from the protein content, there are also many other factors that consumers would consider when purchasing plant-based milk, such as being lactose-intolerant, low calorie count and the product lower environment impact.